What the UK Autumn Budget 2025 Means for EV Drivers

The Autumn Budget 2025 introduces several changes that matter to EV drivers, and while some of the updates bring new costs, others offer meaningful support for anyone already driving electric or planning to switch. Taken together, the picture is balanced and still encouraging for the long-term future of electric mobility in the UK.

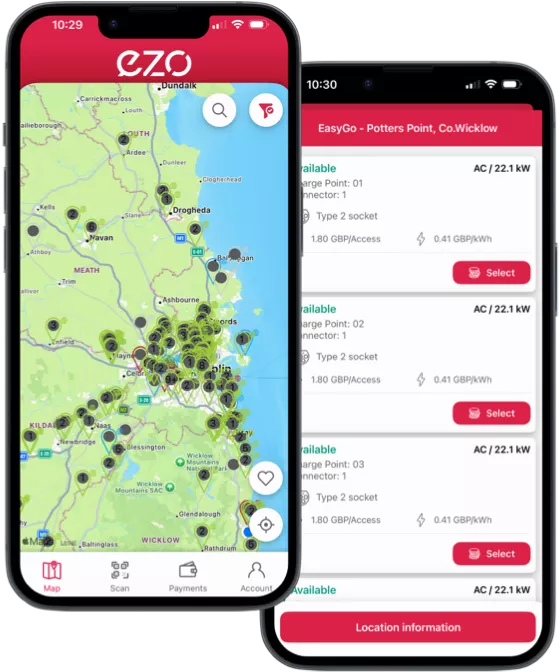

Increased Investment For Public Charging

The government confirmed further investment in public charging infrastructure. An extra £200 million will be allocated to improving the UK’s public charging network and supporting home and on-street charging solutions for people without driveways. This investment is intended to make charging more available and more reliable, especially for drivers who rely entirely on public or shared charging options.

A New Pay-Per-Mile System from 2028

One of the biggest announcements is the introduction of a pay per mile system for electric and plug-in hybrid vehicles from April 2028. Under the new model, fully electric cars will be charged 3p for every mile driven, while plug-in hybrids will be charged 1.5p per mile. This comes in alongside standard vehicle tax and is being introduced to help replace the fuel duty revenue that naturally declines as more drivers adopt electric. Although it is an additional running cost, the rate is relatively modest for many everyday drivers and EVs remain significantly more cost effective to run compared to petrol and diesel cars.

A Higher Threshold for the Expensive Car Supplement

The Budget also brings welcome news for anyone looking to buy a new EV, with the threshold for the Expensive Car Supplement increasing from £40,000 to £50,000 from April 2026. This change is particularly relevant because a large share of today’s EVs, especially family-sized and long-range models, fall within that price bracket. Raising the threshold means fewer drivers will face the £410 surcharge, making EV ownership more accessible at the mid-market level and helping more models fall into standard tax categories.

Electric Car Grant Extended to 2030

Another positive update is the extension of the Electric Car Grant through to 2030 for eligible vehicles under thirty seven thousand pounds. This gives both consumers and manufacturers long-term clarity and reassurance. For anyone considering an EV over the next few years, it means the financial support will remain in place, allowing buyers to better plan their budget while continuing to benefit from lower running costs and sustainable transport.

Fuel Duty Freeze for Petrol and Diesel Drivers

The Budget also confirmed that fuel duty for petrol and diesel vehicles will remain frozen until September 2026, with the temporary five pence per litre reduction set to be phased out afterwards. While this doesn’t directly affect EV drivers, it does form part of the wider landscape. As fuel duty begins to rise again in the coming years, the cost gap between running an EV and a petrol or diesel car is likely to widen once more, reinforcing the long-term savings associated with going electric.

Overall, the Autumn Budget offers a mix of updates, but the direction remains positive for EV adoption. The introduction of pay per mile ensures road funding remains sustainable in the future, while the extension of grants, improved tax thresholds and continued investment in charging infrastructure all support the ongoing shift towards cleaner transport. For current EV drivers, the changes provide clarity and stability. For those considering making the switch, the incentives and long-term benefits remain strong, with clearer guidance on costs for the years ahead.